Elliott Wave Explained Pdf

A basic 5-wave impulse sequence and 3-wave corrective sequence are explained. While Elliott Wave Theory gets. Shown in the Elliott Wave book and the Elliott. DownloadElliott wave explained by robert beckman pdf. Elliott wave explained by robert beckman pdf Direct Link #1. Update BIOS for AMD new E4 CPU. When you sign up, you'll also receive a special bonus, 'Discovering How to Use the Elliott Wave Principle.' Claim Your Free Report. We respect your privacy.

The Elliott wave principle is a form of that use to analyze financial and forecast by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946.

Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.' The empirical validity of the Elliott Wave Principle remains the subject of debate. Elliott's essay, 'The Basis of the Wave Principle,' October 1940.

My Elliott Wave

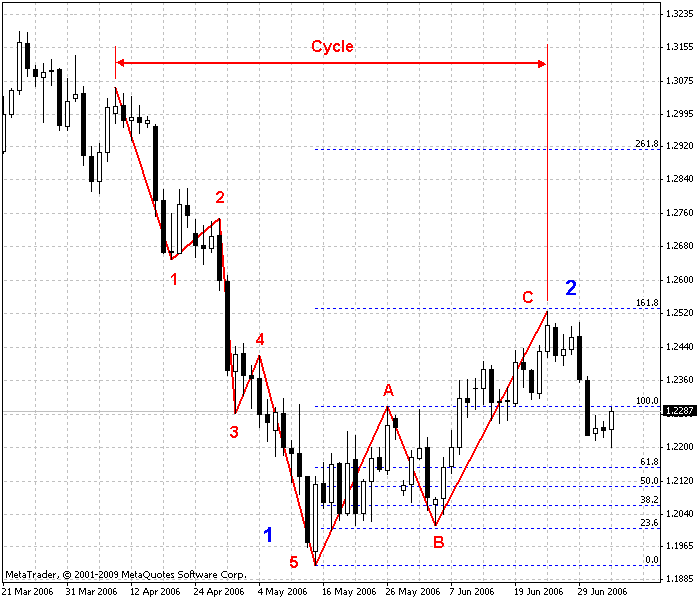

The Elliott Wave Principle posits that collective investor psychology, or, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of or time scale. In Elliott's model, market prices alternate between an impulsive, or motive phase, and a corrective phase on all time scales of trend, as the illustration shows. Impulses are always subdivided into a set of 5 lower-degree waves, alternating again between motive and corrective character, so that waves 1, 3, and 5 are impulses, and waves 2 and 4 are smaller retraces of waves 1 and 3. Corrective waves subdivide into 3 smaller-degree waves starting with a five-wave counter-trend impulse, a retrace, and another impulse. In a the dominant trend is downward, so the pattern is reversed—five waves down and three up. Motive waves always move with the trend, while corrective waves move against it.

Degree The patterns link to form five and three-wave structures which themselves underlie wave structures of increasing size or higher degree. Note the lowermost of the three idealized cycles. In the first small five-wave sequence, waves 1, 3 and 5 are motive, while waves 2 and 4 are corrective.

This signals that the movement of the wave one degree higher is upward. It also signals the start of the first small three-wave corrective sequence. After the initial five waves up and three waves down, the sequence begins again and the self-similar fractal geometry begins to unfold according to the five and three-wave structure which it underlies one degree higher. The completed motive pattern includes 89 waves, followed by a completed corrective pattern of 55 waves.

Each degree of a pattern in a financial market has a name. Practitioners use symbols for each wave to indicate both function and degree—numbers for motive waves, letters for corrective waves (shown in the highest of the three idealized series of wave structures or degrees). Degrees are relative; they are defined by form, not by absolute size or duration. Waves of the same degree may be of very different size and/or duration. ^ Elliott, Ralph Nelson (1994). Prechter, Robert R., Jr., ed.

Elliott's Masterworks. Gainesville, GA: New Classics Library.

Pp. 70, 217, 194, 196. ^ Poser, Steven W. Applying Elliott Wave Theory Profitably. New York: John Wiley and Sons.

^ Frost, A.J.; Prechter, Robert R., Jr. Elliott Wave Principle (10th ed.). Gainesville, GA: New Classics Library. Pp. 31, 78–85. John Casti (31 August 2002).

'I know what you'll do next summer'. New Scientist, p. Poser Applying Elliot Wave Theory Profitably - Page 8 - 2003 - Preview - More editions A subwave is a wave of lesser degree in time and price. All waves, except the tiniest actions (such as would be found on a one-minute bar chart or a tick chart), break down into even smaller waves.

This is commonly referred to as the fractal 5 nature of stock price movement. Some scientists have found evidence of fractals in market prices as well, relating the patrems to chaos theory. One of the most common errors I have seen made in applying EWT is to assume that fivewave cycles. Alex Douglas, 'Fibonacci: The man & the markets,' Standard & Poor's Economic Research Paper, February 20, 2001, pp. Roy Batchelor and Richard Ramyar, 'Magic numbers in the Dow,' 25th International Symposium on Forecasting, 2005, p. 2010-08-01 at.

Robert Prechter (2006), 'Elliott Waves, Fibonacci, and Statistics,' p. Deepak Goel (2006), 'Another Look at Fibonacci Statistics'. 2007-08-11 at the. (2011),. Landon Jr., Thomas (13 October 2007). The New York Times.

Retrieved 26 May 2010. Robin Wilkin, 2009-12-29 at the. The Alchemist June 2006. Jordan Kotick, The Alchemist November 2005.

Sornette, D., Johansen, A., and Bouchaud, J.P. 'Stock market crashes, precursors and replicas.' Journal de Physique I France 6, No.1, pp.

Fisher, The Logical Trader, p. X (forward). Neely, Glenn. Mastering Elliott Wave – Presenting the Neely Method: The First Scientific, Objective Approach to Market Forecasting with the Elliott Wave Theory. Published by Windsor Books.

Mandelbrot, Benoit and Richard L. Hudson (2004). The (mis)Behavior of Markets, New York: Basic Books, p. 245. Mandelbrot, Benoit (February 1999)., p. 2007-02-08 at the.

Aronson, David R. (2006)., Hoboken, New Jersey: John Wiley and Sons, p. References. Elliott Wave Principle: Key to Market Behavior by A.J.

Frost & Published by New Classics Library. Mastering Elliott Wave: Presenting the Neely Method: The First Scientific, Objective Approach to Market Forecasting with Elliott Wave Theory by with Eric Hall.

Published by Windsor Books. Applying Elliott Wave Theory Profitably by Steven W. Published by John Wiley & Sons, Ltd. Elliott's Masterworks by R.N. Elliott, edited by Robert R.

Prechter, Jr. Published by New Classics Library.

Elliott Wave Principle Applied to the Foreign Exchange Markets by Robert Balan. Published by BBS Publications, Ltd. Elliott Wave Explained by Robert C. Published by Orient Paperbacks. Harmonic Elliott Wave: The Case for Modification of R.N. Elliott's Impulsive Wave Structure by Ian Copsey, Published by John Wiley & Sons.

External links.

The flaw in Economics 101 is one of the hardest things for many investors to accept For over ten decades, the mainstream financial world has embraced the view that external news events drive trend changes in the markets. In less than ten minutes, EWI's Senior Tutorial Instructor Wayne Gorman shatters that very idea into a fine dust, swept away into thin air. Recall this expression from a famous, Nobel Prize winning economist: 'Economic reasoning will be of no value in cases of uncertainty.' But as Wayne puts it: 'Isn't that what we have in financial markets: cases of uncertainty? We need a different type of reasoning, one that will help us to avoid the pitfalls shown on the previous charts. That's why the Wave Principle is so important. It offers a unique perspective and a market discipline of rules and guidelines that help investors avoid buying at tops and liquidating at bottoms.

Intel g33 drivers windows 10. It helps to explain and understand trends before they happen.' The flaw in Economics 101 - cause-and-effect theory - is one of the easiest things to prove. But it's also one of the hardest things for many investors to accept. Now is the time to do so through the Elliott Wave Crash Course video series.

Here's the rundown of the three-video series:. Video 1: Why Use the Wave Principle This video uses real headlines, actual events and charts to provide a comprehensive look at what the financial media say drives the markets and why their 'fundamentals' are usually wrong.

And more importantly, you'll learn why Elliott wave analysis is your best tool for forecasting the markets. Video 2: What is the Wave Principle Part 2 gives you a brief biography of Ralph Nelson Elliott, the father of the Wave Principle. But it also explains in vivid detail the recurring 'motive' and 'corrective' patterns Elliott discovered in the DJIA in 1938. Video 3: How to Trade the Wave Principle This final video of the series goes past the history and serves up the 'meat and potatoes' of Elliott wave analysis, sharing real charts and strategies for position management, such as entry, stop, target and risk/reward assessment. After watching this video, you'll know the rules and guidelines and our favorite wave patterns for trading. Time and again, we see that what financial news writers call causes, really aren't causes at all; they're just another clever way to meet a daily word count. You see, the way the news plays it, one day a scandal causes stocks to fall; the next day, the scandal somehow attributes to their rise.

The formula is mixed, repeatedly unproven and most of the time dead wrong. In this video, Senior Tutorial Instructor Wayne Gorman uses real headlines, actual events and charts to provide a comprehensive look at what the financial media say drives the markets and why their 'fundamentals' are usually wrong. And more importantly, you'll learn why Elliott wave analysis is your best tool for forecasting the markets. Wayne Gorman Senior Tutorial Instructor Wayne Gorman, CEWA-M, is head of EWI's Educational Resources. A 40-year veteran risk manager and trader, he started out at Citibank, where he managed trading positions in money markets and derivatives. He traded full-time with his own capital for over four years before joining EWI. In 2013, Wayne co-authored the Amazon best-selling book Visual Guide to Elliott Wave Trading, published by Bloomberg Press.

Wayne is also the author of multiple EWI trading tutorials and a host of live training events for traders.